Made in China: Tech, Ethics and Economics

September 1, 2010 | 07:28

Nowhere else to go

While manufacturers of lower-end products such as running shoes and T-shirts (which typically require minimal investment in capital and labour) have begun flocking to Vietnam and Bangladesh, where wages are lower, China remains the location of choice for technology outsourcing.“They're saying that the Chinese manufacturing model does not make sense any more, but I’m not ready to agree with that,” said David Levy, general manager at a US factory in Dongguan, Guangdong province. “If there's a change in labour costs, so what? Labour costs have already been going up 20-30%. And if you don’t do business here, then where do you go? Vietnam is the closest competitor to China and it’s not there yet because of the poor infrastructure.”

China’s manufacturing sector saw average annual wage growth of 14.5% per year between 2004 and 2008, and 13% in the five years before that. Wang Tao, chief China economist at UBS, points out that double digit wage growth is to be expected in a rapidly growing economy, and that productivity gains make up much of the difference in terms of cost to the firm outsourcing the manufacturing.

Western corporations are increasingly dependent on Chinese factories

Aside from China’s clear advantage over regional competitors in terms of scale, it also offers a skilled workforce, fully integrated supply chains for components, and strong infrastructure that minimizes the time and cost of getting finished goods to port. Put simply, you're going to be seeing 'Made in China' stamped on your tech products for a long time yet.

The electronics industry in particular has exhibited a remarkable resilience to the impact of salary increases as shown by companies’ fairly consistent profit margins. There are three reasons for this: technological advances, an ability to pass on costs to the customer, and improvements in operational efficiency that minimizes costs across the board.

Hon Hai and its peers are able to pass on the impact of wage increases to their customers largely due to the fact that the labour share of total production cost is relatively small. A study carried out by the University of California Irvine in 2008 established that the factory cost of a 30GB iPod was US$144, of which the China-related share was just 12.9%. Based on a retail price of US$299, the China share was 6.2% - a price increase of 1% would therefore be enough to cover a 20% rise in production costs in China.

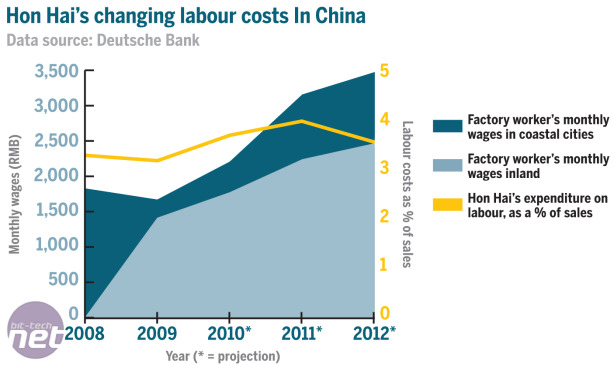

This graph shows the trend for rising wages in Chinese factories; EMS firms such as Hon Hai have moved away from traditional coastal locations to find a lower cost workforce, but in a fast growing economy such as China, the wages for workers inland are also rising. What's interesting is that over the same period, wages as a percentage of Hon Hai's expenditure remain fairly stable. Outsourcing to China doesn't just work well for Western companies.

More recently, K.C. Kao, a research analyst Deutsche Bank in Taipei, reached similar conclusions. For a PC that retails at US$600, Chinese labour accounts for US$18, or 3%; for a US$499 iPad, Chinese labour accounts for US$9, or 1.5%. Based on these calculations, price hikes of US$2 and US$1 for PCs and iPads respectively would absorb a 10% rise in Chinese workers’ wages.

Over the coming years, a key strategy among manufacturers is moving factories from coastal regions to China’s interior. According to K.C. Kao, come 2012, one of Hon Hai’s coastal employees will be taking home over RMB1,000 a month more than his inland counterpart, including overtime and benefits - but by that point, 60% of Hon Hai’s 700,000 strong China workforce is likely to be based inland, compared to just 10% in 2009.

Long cited as the future of manufacturing in China and seen by the ruling Communist party as a key way to spread wealth into the less developed hinterlands, it would appear that the tech sector is finally moving away from its traditional Pearl River Delta heartland for cheaper locations to the north and west. Hon Hai already has plants in Yantai in Shandong province, Langfang in Hebei, Wuhan in Hubei and the western municipality of Chongqing. Henan, Sichuan and Chongqing are responsible for the bulk of migrants who seek work in China’s coastal provinces, so it makes sense to set up closer to their homes.

MSI MPG Velox 100R Chassis Review

October 14 2021 | 15:04

Want to comment? Please log in.